Whether you’ve been following a DIY approach for your small business or working with a payroll provider, it may be time to make a change.

If you’re one of the many small businesses that do their own payroll, you will likely agree that it is very time-consuming and oftentimes confusing. But, switching your payroll process may feel like an overwhelming task, and depending on when you make the change, the timing can be complicated. However, it may be necessary for your business’s success to switch your payroll process – to save money, to streamline your operations, or to free up your time to grow your business. At CRI Payroll Services, we have successfully managed our clients’ switch from other payroll solutions, no matter what time of the year you decide to make the change. However, the best time to evaluate your payroll software or payroll service is at the end of a quarter or year. As we’re approaching year-end, it is time to ask yourself some critical questions.

Is your current payroll solution disrupting your business operations?

Does your payroll team experience technology or software trouble and without support?

Are you experiencing frequent payroll errors or penalties?

Does your payroll solution also offer time tracking software?

Is your current payroll process hurting your employee retention – due to pay errors, delays, or inconvenient payment methods?

If you have answered yes to any of these questions, then it’s time to consider a change. CRI Payroll Services clients have switched to our full service payroll because of our personalized customer service. It’s straightforward; we do the work for you. Payroll penalties are significant and could be costing your business. It’s important to understand that as a full-service payroll provider, we know the questions to ask; we aren’t a 1-800 number with a different person every time there is a payroll question.

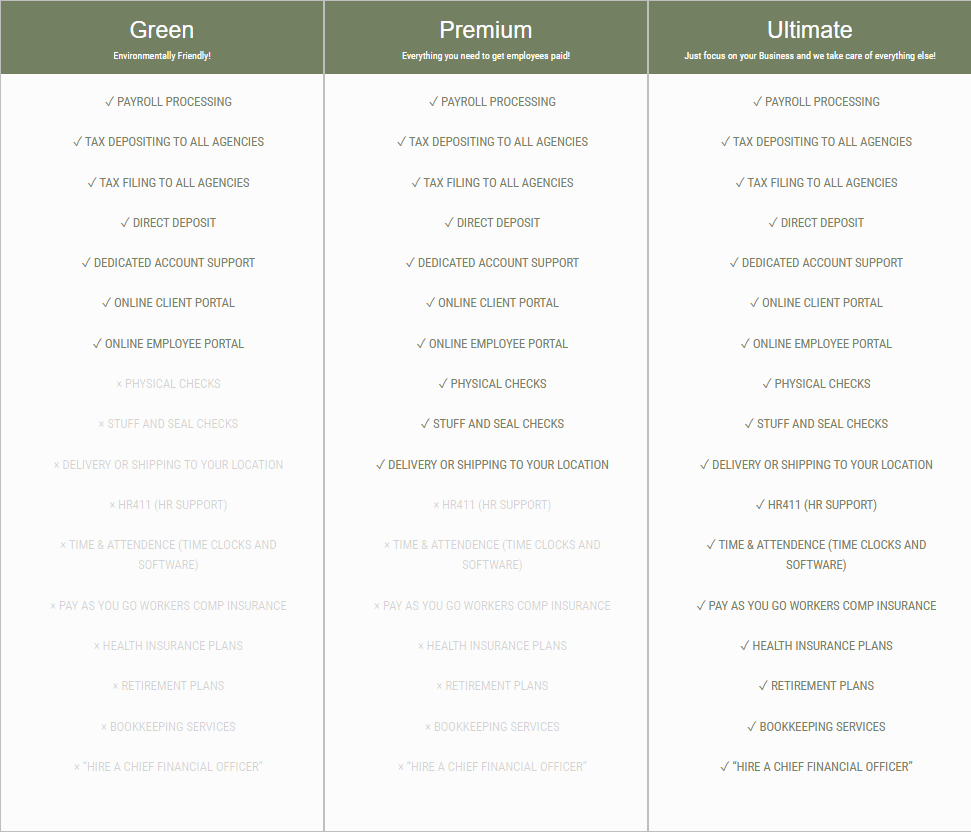

We offer three individual full service payroll packages.

Final Thoughts

Switching payroll companies may seem difficult. However daunting it may seem, choosing a payroll solution that can provide your company with excellent customer support and service is necessary. CRI Payroll Services is ready to assist you with this decision and will make your switch easy. For a limited time, CRI Payroll Services will offer two (2) months of FREE payroll services for new clients ready to make the switch. Contact CRI Payroll Services to learn more.