Blog

Avoiding the IRS Radar: Common Payroll & HR Compliance Audit Triggers

Avoiding the IRS Radar: Common Payroll & HR Compliance Audit Triggers If you’re a small business owner, the idea of an IRS audit can strike fear into your heart. Small and medium-sized businesses, particularly those with fewer than 500 employees, are more likely...

Compliance or Consequences: Key HR Regulations You Can’t Ignore

Compliance or Consequences: Key HR Regulations You Can't Ignore No business owner wants to receive an IRS notice for a compliance penalty. Non-compliance with HR regulations can result in significant penalties for your business, no matter its size. All businesses must...

ELIMINATE YOUR PAYROLL & HR HASSLES

Running a small business is no easy task, and managing payroll and HR can be some of the most challenging and time-consuming aspects. If you’ve been handling these functions yourself or using less-than-ideal services, it might be time for a change. Upgrading your...

9 Common Bookkeeping Mistakes & How to Avoid Them

Small business owners often have fewer resources at their disposal, which means the owner ends up wearing many different hats. Keeping an eye on growth, profits and sustainability are full-time responsibilities. Yet many small business owners find themselves handling...

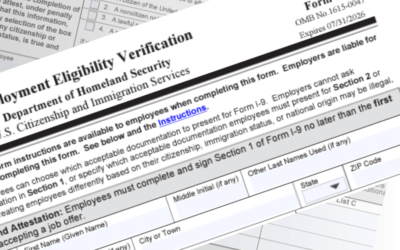

THE NEW FORM I-9 TO STAY COMPLIANT

Compliance requirements are constantly changing! On July 21, 2023 the United States Citizenship and Immigration Services (USCIS) announced a new Form I-9, which became available on August 1, 2023. Employers should begin using the new Form I-9 now during the hiring and...

5 Tips to Master Payroll Basics for Every Employer

Are you an employer looking to master payroll basics? If so, you’ve come to the right place. Payroll basics and compliance can be intimidating, but with the right guidance, it doesn’t have to be. In this article, we’ll provide five helpful tips to get you up to speed...

9 Questions To Ask An Accountant If You Want To Grow Your Business

Here are the top 9 questions to ask an accountant if you want your business to grow.

Accounting Process for a Successful Year-End Close

CRI Payroll Services’ article provides a simple accounting process for a successful year-end close. This will help ensure that all your accounting needs are covered.

Online Payroll Services for Small Businesses

Payroll can be a challenging process for small business owners. Whether you’re managing a handful of employees or a larger staff, it’s essential to have a reliable online payroll service to ensure accuracy and efficiency. With the right online payroll service, small...

The Advantages of Having A Separate CPA & Bookkeeper

Accounting is one aspect that is common to all businesses. Whatever enterprise you are running, you must regularly be aware of your financial situation and meet your financial obligations to local, state, and federal tax authorities. One great way to achieve this is…

8 Common Small Business Payroll Errors

Managing payroll is one of the most crucial functions of any small business. When done correctly, it can help keep your employees satisfied and the company free from legal conflicts. However, handling business payroll can be complicated for untrained staff. Payroll mistakes can have costly consequences.

Are You Ready To Change Payroll Solutions?

Whether you've been following a DIY approach for your small business or working with a payroll provider, it may be time to make a change. If you're one of the many small businesses that do their own payroll, you will likely agree that it is very time-consuming and...

Check Your Job Application Form – Avoid These Mistakes

When was the last time you reviewed your company’s employment application form? Your application form can provide valuable information about job seekers, more than may be included on their resume. Plus your application form allows you to make specific and standardized...

Time to Hire an Employee? Here’s What You Need To Know

As a small business owner, you try to keep overhead expenses low and juggle many responsibilities as you launch your business. When the enterprise starts to earn and tasks get too overwhelming, hiring the company’s first employee may be necessary.

The Small Business Guide to New Employee Orientation

Conducting an effective new employee orientation is a crucial onboarding step. By making sure your new hires are comfortable in their new environment, complete their payroll and employment paperwork, and are aware of your expectations, you can help set them (and your company) up for success.

Starting a Small Business: A 2022 Guide

There is no one-size-fits-all approach to starting a new small business. However, this guide will assist you in ironing out the crucial start-up details.

How to Stay Payroll Compliant with the New IRS Standard Mileage Rate 2022

No matter who or where you are, you've felt the impact of high gas prices. The IRS has responded by increasing the standard mileage rate for the business use of employees' vehicles for the remaining 6 months of 2022. From July 1 to December 31, 2022, the IRS standard...

7 Actionable Ways to Improve your Small Business’ Employee Handbook

Employee handbooks. Like most small businesses, you probably have one - but are your employees using it? Unfortunately, the odds are not in your favor. Research shows that more than half of employees actually avoid reading employee handbooks. It’s no secret that...

11 Important Ways an Employee Handbook Can Help Your Small Business

$1,580,000,000 That’s the total amount U.S. businesses paid in workplace class action settlements in 2020 alone - and small businesses aren’t immune. From discrimination to wage and hour disputes, settlements have been on the rise in recent years and COVID-19 has...

IS YOUR BUSINESS READY FOR THE NEW FORM W-4?

The IRS has updated, revised, and redesigned the employee withholding Form W-4 for 2020. The new form reflects changes made by the Tax Cuts and Jobs Act which took effect last year, It is designed to be simpler for employees and to allow for more accurate withholding...

PLAN FOR BRINGING EMPLOYEES BACK TO THE WORKPLACE

With the surge of the COVID Delta variant, the plans that many companies had put into place to bring workers back to the office and get back to “normal” have once again been delayed. Is your business one of them? Since it is certainly true that the only constant is...

PAYROLL SOFTWARE OR A PAYROLL SERVICE – WHAT’S THE DIFFERENCE?

All businesses need a solid payroll solution, whether from a payroll service provider or by just using payroll software. Even the smallest businesses benefit by automating and eliminating the hassles and tedium that come with payroll. It’s a never-ending process! But...

EMPLOYEE RETENTION CREDIT COVID-19: HOW TO GET IT [INFOGRAPHIC]

The Employee Retention Credit (ERC) has some changes for 2021 and your business probably qualifies – even if you didn’t previously qualify for the ERC under the 2020 guidelines. The recently enacted Employee Retention Credit (ERC) provides additional support to...

SOCIAL SECURITY WAGE BASE INCREASES TO $132,900 FOR 2019

On October 11, the Social Security Administration (SSA) announced that the 2019 social security wage base will be $132,900, an increase of $4,500 from $128,400 in 2018 [SSA, Press Release, 10-11-18]. The FICA tax rate remains 7.65% for 2019 up to the social security...

BUSINESS OWNERS CAN CLAIM A QUALIFIED BUSINESS INCOME DEDUCTION

Eligible taxpayers may now deduct up to 20 percent of certain business income from domestic businesses operated as sole proprietorships or through partnerships, S corporations, trusts, and estates. The deduction may also be claimed on certain dividends....

TAX CUTS AND JOBS ACT: A COMPARISON FOR BUSINESSES

The Tax Cuts and Jobs Act (TCJA) changed deductions, depreciation, expensing, tax credits and other tax items affecting businesses. This side-by-side comparison can help businesses understand the changes and plan accordingly. Some provisions of the TCJA...

TAXPAYERS SHOULD BE ON THE LOOKOUT FOR NEW VERSION OF SSN SCAM

Taxpayers should be on the lookout for new variations of tax-related scams. In the latest twist on a scam related to Social Security numbers, scammers claim to be able to suspend or cancel the victim’s SSN. It’s yet another attempt by con artists to frighten people...

TAXPAYER RELIEF INITIATIVE

Taxpayer Relief Initiative aims to help those financially affected by COVID-19 *Information provided directly from IRS.gov* The IRS reviewed its collection activities to see how it could provide relief for taxpayers who owe taxes but are struggling financially...

Looking for Online Payroll Services for Business?

Payroll is an important aspect of running any business. This is something you cannot afford to take lightly. If you take care of your employees by ensuring they get paid on time, you will be able to increase your profits. By providing your employees with the support...

Best Online Payroll Management Software

Online payroll has a lot of benefits over traditional payroll software systems, one of which is that it makes the entire payroll process very easy for the employer to administer. Most online payroll management software packages come with the complete set of features...

Benefits of Online Payroll Services

For a business that does not have an in-house payroll department, the idea of online payroll services can be attractive. The basic benefit to this is the fact that one does not need to meet up with a CPA or payroll person at the office every day. It is the information...

Online Payroll Services in USA

Many of us who run small businesses in the United States are using online payroll services in USA to simplify our payroll process. If you are a business owner and you need to keep track of your employees' salaries, you can hire an online payroll services provider in...

Drop us a line!

REVIEWS

100% RECOMMENDED

![EMPLOYEE RETENTION CREDIT COVID-19: HOW TO GET IT [INFOGRAPHIC]](https://cripayroll.com/wp-content/uploads/2021/02/Screen-Shot-2021-02-25-at-12.10.59-AM-400x250.png)