by CRI Payroll Services | Feb 23, 2021 | All Posts

Eligible taxpayers may now deduct up to 20 percent of certain business income from domestic businesses operated as sole proprietorships or through partnerships, S corporations, trusts, and estates. The deduction may also be claimed on certain dividends....

by CRI Payroll Services | Feb 23, 2021 | All Posts

The Tax Cuts and Jobs Act (TCJA) changed deductions, depreciation, expensing, tax credits and other tax items affecting businesses. This side-by-side comparison can help businesses understand the changes and plan accordingly. Some provisions of the TCJA...

by CRI Payroll Services | Feb 23, 2021 | All Posts

Taxpayers should be on the lookout for new variations of tax-related scams. In the latest twist on a scam related to Social Security numbers, scammers claim to be able to suspend or cancel the victim’s SSN. It’s yet another attempt by con artists to frighten people...

by CRI Payroll Services | Feb 23, 2021 | All Posts, IRS

Taxpayer Relief Initiative aims to help those financially affected by COVID-19 *Information provided directly from IRS.gov* The IRS reviewed its collection activities to see how it could provide relief for taxpayers who owe taxes but are struggling financially...

by CRI Payroll Services | Feb 23, 2021 | All Posts, Payroll

Payroll is an important aspect of running any business. This is something you cannot afford to take lightly. If you take care of your employees by ensuring they get paid on time, you will be able to increase your profits. By providing your employees with the support...

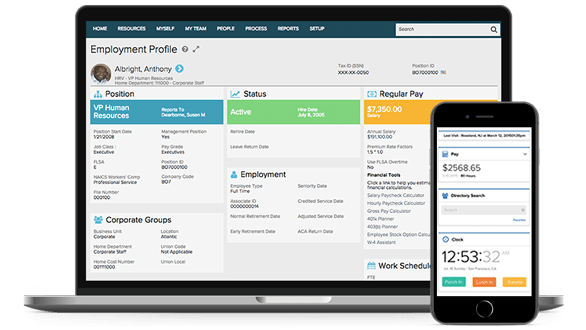

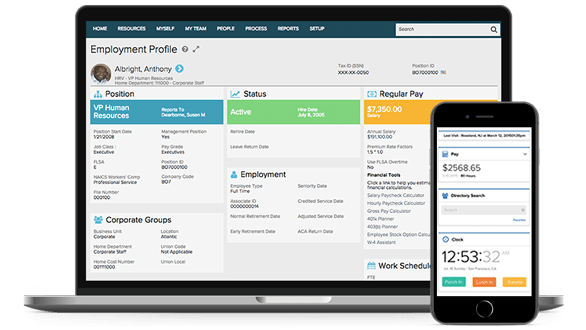

by CRI Payroll Services | Feb 23, 2021 | All Posts, Payroll

Online payroll has a lot of benefits over traditional payroll software systems, one of which is that it makes the entire payroll process very easy for the employer to administer. Most online payroll management software packages come with the complete set of features...